How much can you save on electricity bills with solar

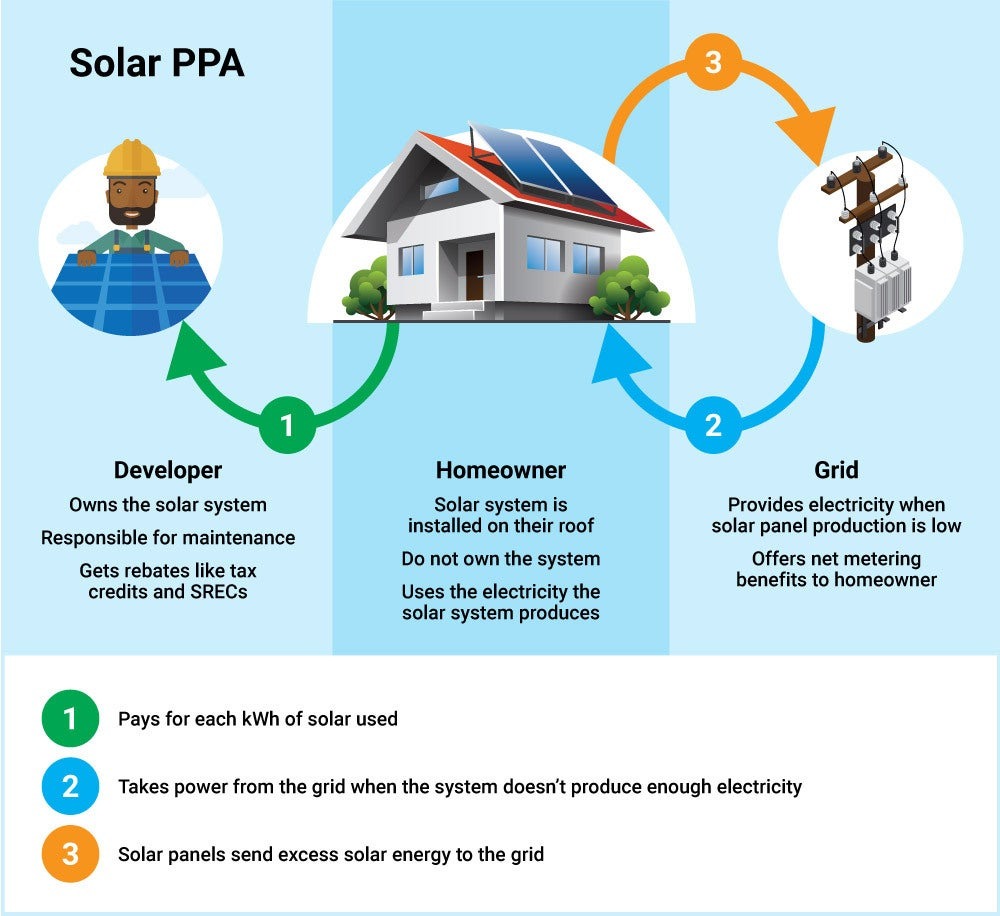

Solar power purchase agreements (PPAs) are a popular financing option for those looking to install solar panels on their roofs. PPAs allow you to install a home solar system on your roof with no upfront costs. Instead, you pay the solar company every month for every kilowatt-hour of solar energy the panels produce.

Because you aren’t the one who owns the solar panels with a PPA, you don’t get to take advantage of all of the incentives that may be available near you, most notably, the federal solar tax credit. But, PPAs can still offer great electricity bill savings for some homeowners.

Key takeaways

-

When a homeowner enters a solar PPA, they do not own the solar panels on their roof, but instead pay a monthly payment to a solar company for each kilowatt hour of solar the system produces at a rate lower than their local utility rate.

-

The homeowner gets to use all of the electricity the solar panels produce which reduces their utility bill through net metering, but they do not own the solar panels.

-

Because they do not own the system, homeowners with solar PPAs cannot take advantage of the federal tax credit or other solar incentives.

-

Solar PPAs allow you to avoid the upfront costs of a solar installation but you get lower lifetime savings than if you had purchased the solar panels.

-

In most cases, the only time it makes sense to get a solar PPA instead of purchasing solar panels is if you don’t qualify for the federal tax credit.

What is a solar power purchase agreement?

A solar PPA is a type of solar financing agreement. With a PPA, a homeowner does not have to pay for the upfront costs of a solar system.

Instead, they enter a contract with a third-party owner or solar developer who will take care of the design, permitting, and installation of their solar panel system.

In return, the homeowner pays the developer for the energy the solar panels produce at price lower than the utility’s cost of electricity.

How does a solar PPA work?

A homeowner, also referred to as the host customer, can enter a PPA with a solar installer with terms that range anywhere from five to 25 years. The solar developer will install the panels on the host customer’s roof, which will cover the home’s electricity usage.

If the solar panels produce more energy than the home needs, the extra kilowatt hours will be sent to the utility grid. The good news is, PPAs allow you to take advantage of net metering benefits your utility offers, so you can wipe out your utility bill.

However, because the solar developer owns the solar system, and not you, they get to receive incentives like the federal tax credit and SRECs.

However, this doesn’t mean you don’t have an electric bill. Because you don’t own the solar panels on your roof with a PPA, you send a monthly payment to the PPA company for each kilowatt hour of solar energy you use.

The PPA company will charge a price lower than the utility rate of electricity, so the electric bill you receive from the solar developer will be less than what you would have paid your utility for energy. Most solar PPA agreements also include a price escalator, which means the amount you pay for solar will increase each year.

If you need more electricity than the solar panels produce, you will pull electricity from the grid. This means that you will have two electric bills:

A bill from your utility company for the energy you consumed from the grid

A bill from the solar company for your PPA payment

At the end of your PPA contract, you can choose to renew the agreement, have the system removed, or purchase the solar panels at fair market value. However, purchasing the system at the end of the contract would actually cost you more in the long run than if you had purchased a system to begin with.

How much can you save with a solar PPA?

The amount that you will save on electricity costs with a solar PPA varies, depending on:

Your energy usage

Your utility’s cost of energy

The cost of energy established in the PPA contract

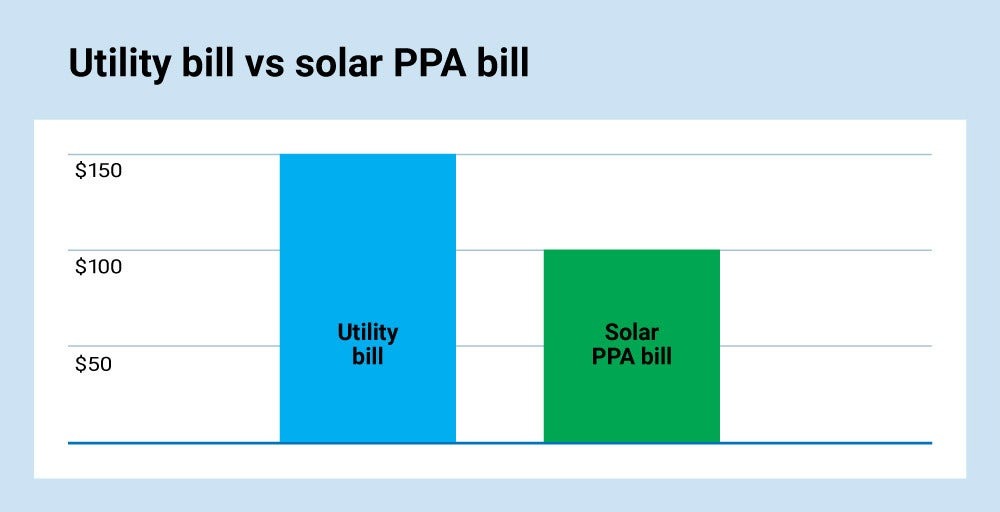

The easiest way to understand solar PPA savings is with an example. Let’s say you enter into an agreement with a PPA price of $0.10 per kWh of solar electricity. Your utility’s price of electricity is $0.15 per kWh.

In one month, your home consumes 1,000 kWh and the solar panels on your roof produce 1,000 kWh.

Because of net metering, the solar energy produced on your roof will eliminate your utility bill, which would have been $150 if you did not have solar.

However, you still have to pay the solar developer for the 1,000 kWh of electricity generated by the system. This would bring your solar PPA bill to $100.

So, you wind up with a total savings of $50 on electricity costs with a solar PPA.

What are the pros and cons of a solar PPA?

Pros | Cons |

|---|---|

No upfront costs | Not eligible for federal tax credit or other incentives |

Energy bill savings and net metering benefits | Lower long-term savings compared to purchasing a system |

Predictable energy pricing | Entering into a long-term contract |

Not responsible for system maintenance/monitoring | Can be difficult to pass over agreement when trying to sell home |

Advantages of a solar PPA

The good thing about solar PPAs is that you don’t have to pay the upfront capital or maintenance costs associated with going solar, but you still get to enjoy the benefits of renewable energy, like a lower electricity bill.

You will also be able to take advantage of net metering.

Plus, you get the advantage of predictable energy pricing, since your contract will outline exactly how much you will pay every year. Your utility, on the other hand, can increase your electric rate however they want without warning.

Since you don’t own the system, you won’t have to worry about taking care of regular system maintenance or performance monitoring - the company you enter into the PPA with will take on this responsibility.

Disadvantages of a solar PPA

Unfortunately, the long-term savings you get with a PPA are substantially lower compared to savings from purchasing solar panels outright or through a solar loan. Also, you might not be able to take advantage of certain solar incentives, like the federal tax credit or local incentives like SRECs, which would save you a lot of money.

And while you do have the advantage of having predictable energy pricing with a solar PPA, you also have to enter a long-term contract. These contracts can sometimes prevent you from doing things like planting trees or doing construction work on your home, as it could impact the solar panels’ production.

Plus, if you try to sell your home, while you do have the ability to pass the PPA to the next owner, it could be difficult to find a buyer willing to enter the agreement.

Things to consider before entering a solar PPA

There are a few things to think about when you are deciding whether or not to enter into a solar PPA, including other financing options that may be better in the long run.

Incentives

Before you enter into a long-term agreement with a third-party owner, you should consider what incentives you would receive had you purchased a solar energy system.

If you are eligible for the federal investment tax credit, SRECs, or other local tax incentives, you might be better off purchasing a system or taking out a solar loan. These incentives and rebates have the potential to save you thousands of dollars over the lifetime of your system - but you can’t take advantage of them with a PPA.

Contract terms

You should always review what is written in a PPA contract with a close eye. The contract may include clauses that prevent you from making certain home and landscaping upgrades that could impact the solar system’s production.

It may also outline how much the developer can increase your cost for solar electricity each year. It’s important to keep these things in mind before entering the agreement.

Other financing options

Besides solar PPAs, there are a few other ways you can finance a rooftop solar installation, including:

Purchasing a system in cash

Taking out a solar loan

You should compare all of these options before entering a solar PPA. While free solar panels might sound like an attractive offer, other financing options could save you more on your energy costs.

So, it’s important to consider all of the financing options available to find the right one for you.

Is a solar PPA the right financing option for you?

A solar PPA might be the right financing option for you if:

You are not eligible for the federal tax credit

You are not eligible for SRECs

You do not qualify for a solar loan

However, in most cases, purchasing a solar panel system will give you the most bang for your buck. Buying a solar panel system, whether with cash or a solar loan, allows you to see much greater long-term savings over the lifetime of your system.

In order to find out the best option for you, you should get multiple solar quotes from installers.

Catherine is the Written Content Manager at SolarReviews, where she has been at the forefront of researching and reporting on the solar industry for five years. She leads a dynamic team in producing informative and engaging content on residential solar to help homeowners make informed decisions about investing in solar panels. Catherine’s expertise has garnered attention from leading industry publications, with her work being featured in Sola...

Learn more about Catherine Lane