Updated 5 months ago

IRS Form 5695 Instructions: How to Claim the Solar Tax Credit (2024 Tax Year)

Written by Ben Zientara Ben ZientaraBen Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state util...Learn more , Edited by Catherine Lane Catherine LaneCatherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dyna...Learn more

Why you can trust SolarReviews

SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry experts have a combined three decades of solar experience and maintain editorial independence for their reviews. No company can pay to alter the reviews or review scores shown on our site. Learn more about SolarReviews and how we make money.

It’s that time of year again—tax time! But this year is different because this was the year you installed solar panels on your home (or qualifying property), and now you’re ready to get that solar tax credit. And we’re here to help guide you through the process!

To claim the solar tax credit, you’ll need all the receipts from your solar installation, as well as IRS form 1040 and form 5695 and instructions for both of those forms.

We’ve included an example below of how to fill out the tax forms and some frequently asked questions about the process of claiming the 30% tax credit.

We are solar people, not tax people. We do not give tax advice; anything you read on this page is merely one example of how someone might act. Please consult a tax professional before filing.

What you need to claim the tax credit

The receipts from your solar installation

IRS Form 1040, which is your individual income tax return

IRS Form 1040, Schedule 3, where you calculate additional credits and payments

IRS Form 5695, which is the Residential Energy Credit form

Residential Clean Energy Credit Limit Worksheet - Line 14 to help calculate the tax credit value

Instructions for these forms (also available from the links above)

Fill out your Form 1040 as you normally would. Stop when you reach line 20, and move to Schedule 3, where you can fill in other payments and additional credits, like the solar tax credit. To figure out your tax credit value, you’ll use Form 5695.

How to fill out form 5695

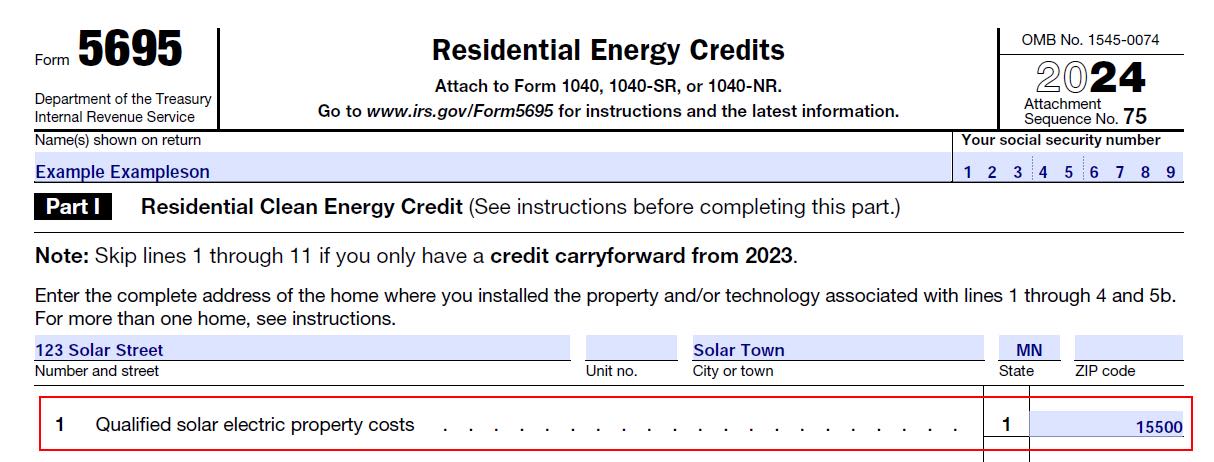

Today, we’re helping “Example Exampleson,” who hails from Minnesota, dontcha know. His 6.2 kW solar panel installation cost $15,500, and he is now filling out his tax forms for the year. Here’s how he did it:

Step 1: Fill out Line 1 with qualified solar electric property costs

Mr. Exampleson begins working on his Residential Energy Credit form by filling out line 1 of form 5695 with the total cost of his solar system ($15,500):

What exactly is a qualified solar electricity property cost? Here’s what the instructions for Form 5695 say:

"Include any labor costs properly allocable to the onsite preparation, assembly, or original installation of the residential energy efficient property and for piping or wiring to interconnect such property to the home.

Qualified solar electric property costs are costs for property that uses solar energy to generate electricity for use in your home located in the United States. No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed. Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof's decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit. The home does not have to be your main home."

All that is a fancy way of saying “Pretty much any cost related to installation and materials of solar energy generating property counts. Claim it.”

Battery storage is a separate line. If you also installed a solar battery, it may qualify for the tax credit, too. Check the instructions for Form 5695 to see if your energy system qualifies. If it does, check Yes on line 5a, and enter the qualified battery technology costs on line 5b.

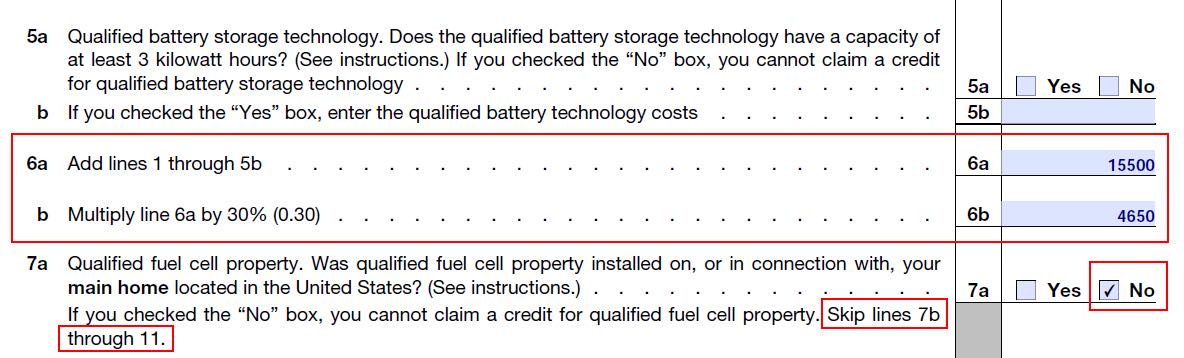

Step 2: Calculate the total credit value

If you installed other qualifying energy properties, fill out their respective costs on lines 2 through 5. Then, add together the values of lines 1 through 5b to get the total value of your renewable energy costs and fill in line 6a.

Multiply the value in 6a by 30%, and enter the amount in column 6b. That is the value of your tax credit.

Note: if your installation included battery energy storage with more than 3 kilowatt-hours of capacity, you can claim those costs on this form as well. Costs for energy storage go on line 5b and get added together with solar costs on line 6a.

Mr. Exampleson got a solar-only system without a battery, so he fills in line 6a with his qualified solar costs of $15,500. This means his tax credit value is $4,650.

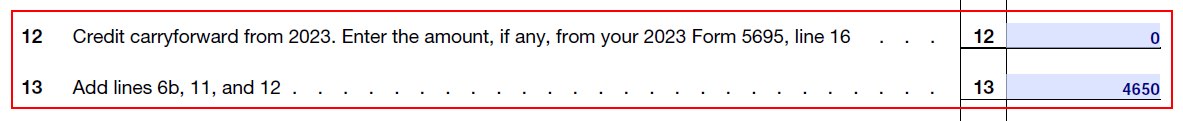

Skip to line 12 unless you installed fuel cell property, and enter in any credit you’re carrying over from a qualified energy property installation (like a previous solar installation) from the previous year. Then fill in line 13 with the total amount of credit from lines 6, 11, and 12. In Mr. Exampleson’s case, he has no prior-year credit to add, so he just puts the same $4,650 from line 6:

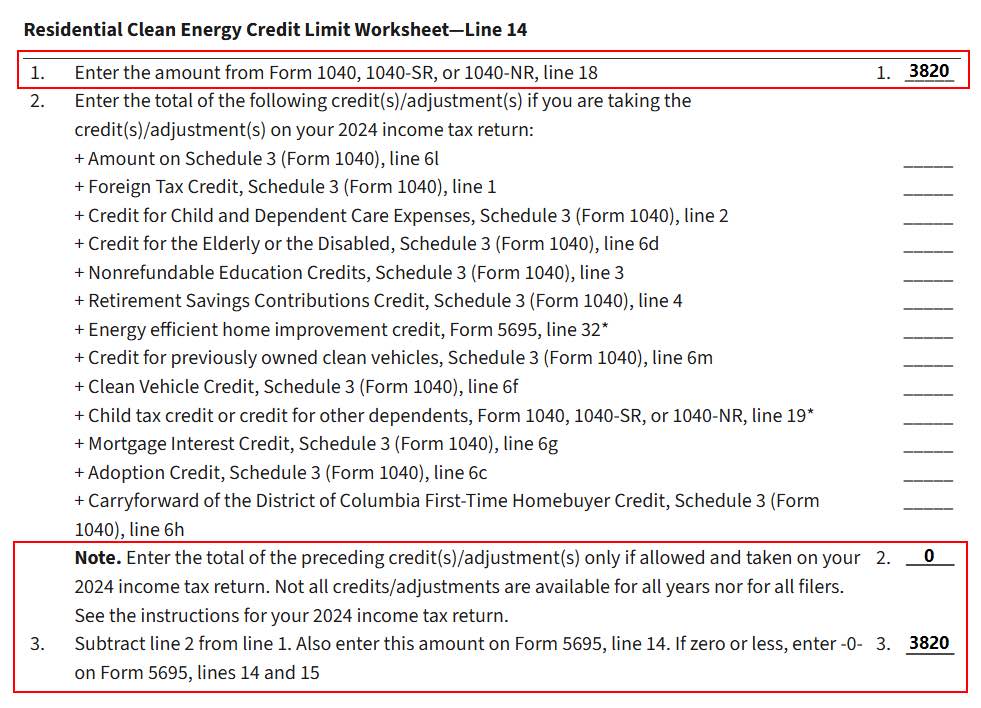

Step 3: Form 5695 line 14 worksheet

Line 14 is where it gets tricky. The thing about the solar tax credit is it isn’t “fully refundable,” meaning you can only take a credit for what you would have owed in taxes. This is different from other fully refundable tax credits like the Child Tax Credit and the Health Coverage Tax Credit.

That’s why you need the worksheet below. You enter the total tax you owe before credits in line 1 of the worksheet, and the amounts of any fully refundable credits on the lines within step 2, adding them all on the final line.

Then, subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. This is the total amount you can claim for the solar tax credit.

Here’s what the line 14 worksheet looks like for Mr. Exampleson, who has an initial tax liability (listed on line 1 below) of $3,820 this year and can claim no other tax credits:

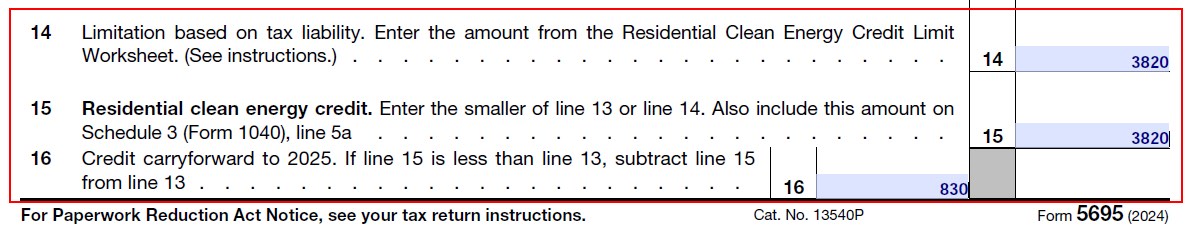

Step 4: Form 5695 Line 14 reducing the credit

Because Mr. Exampleson only owes $3,820 in taxes this year, that’s all the credit he can take now. He enters that number on lines 14 and 15 of Form 5695. Because his total tax credit value is $4,650, but he can only use $3,820, he has $830 remaining to carry forward to his 2024 taxes. He fills out line 16 with $830.

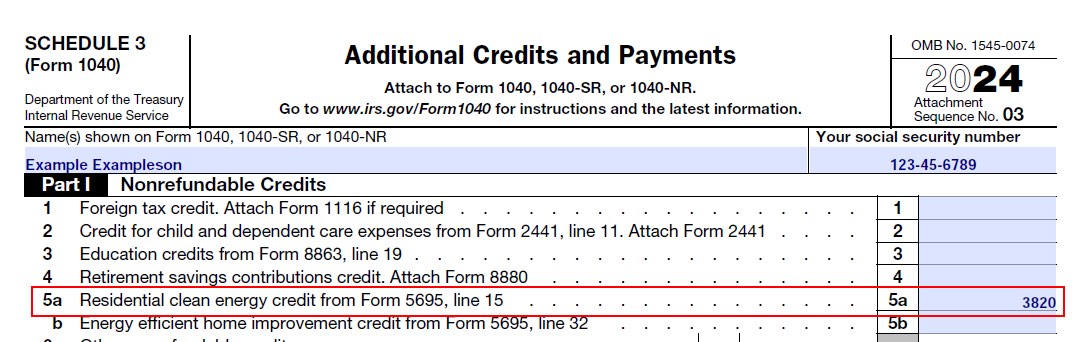

Step 5: Fill out IRS Form 1040 Schedule 3

Finally, he enters the $3,820 into line 5 of Schedule 3 from line 15 on Form 5695.

That’s it! Mr. Exampleson owes $0 in taxes this year and will get to use $830 of his credit on his 2025 tax return! Now he can send his documents to his financial advisor to make sure everything checks out before officially filing.

Frequent Form 5695 questions and considerations

I got a rebate from my utility company for my solar panels. Do I calculate the 30% tax credit before or after the reduction from the rebate?

We always get this question, and here’s the best answer: You calculate the 30% federal tax credit based on the cost to you after any solar rebates. Here’s the tricky part: if your state ALSO gives you a tax credit, you don’t need to worry about that amount to calculate your federal credit.

Both state and federal tax credits are calculated based on the amount you paid, minus rebates or grants.

Can I claim the tax credit using a tax software program?

Yes, you can claim the tax credit using a tax software program. You'll likely have to search for Form 5695 and add it to your other tax documents. The software will likely walk you through the information you need to input and automatically handle calculations.

If I installed a solar panel system a few years ago and now I want to add new panels, can I claim the credit?

Yes! You can claim the credit for any new costs associated with adding new solar panels. You can’t go back and claim the credit for the previously installed equipment. Hopefully, you already claimed the credit for those costs back then.

I just received a quote from a solar company. They informed me that I needed a new roof to hold the solar array. Can I get the tax credit based on the cost of both the roof and the solar, as it was an additional cost?

Let’s be clear again that we’re not tax experts, but it looks like the answer is no, based on the instructions for form 5695. What they’re saying is, “costs for anything that is necessary to have a regular roof cannot qualify as solar costs.” But again, review with a tax professional to determine what costs qualify.

If I install solar and claim the tax credit, will I have to repay the credit to the government if I sell my house within a certain number of years?

No! If you install a solar panel system on a home you own, you can claim the whole credit and sell at any point afterward. If you are buying a house with solar panels—even if the previous owner just installed them—you’re not eligible for any portion of the tax credit.

Should I claim the tax credit if I partially paid (i.e., a deposit) in 2024 for an installation that won’t be completed until 2025?

No. The instructions for Form 5695 say “Costs are treated as being paid when the original installation of the item is completed,” so you can claim all the costs for your installation no matter when they were paid, but you have to wait to claim them in the year the installation takes place. Keep receipts!

Ben Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state utility policy since 2013. His early work included leading the team that produced the annual State Solar Power Rankings Report for the Solar Power Rocks website from 2015 to 2020. The rankings were utilized and referenced by a diverse mix of policymakers, advocacy groups, and media including The Center...

Learn more about Ben Zientara