Florida Solar Incentives and Tax Credits 2025: How to Apply and Save

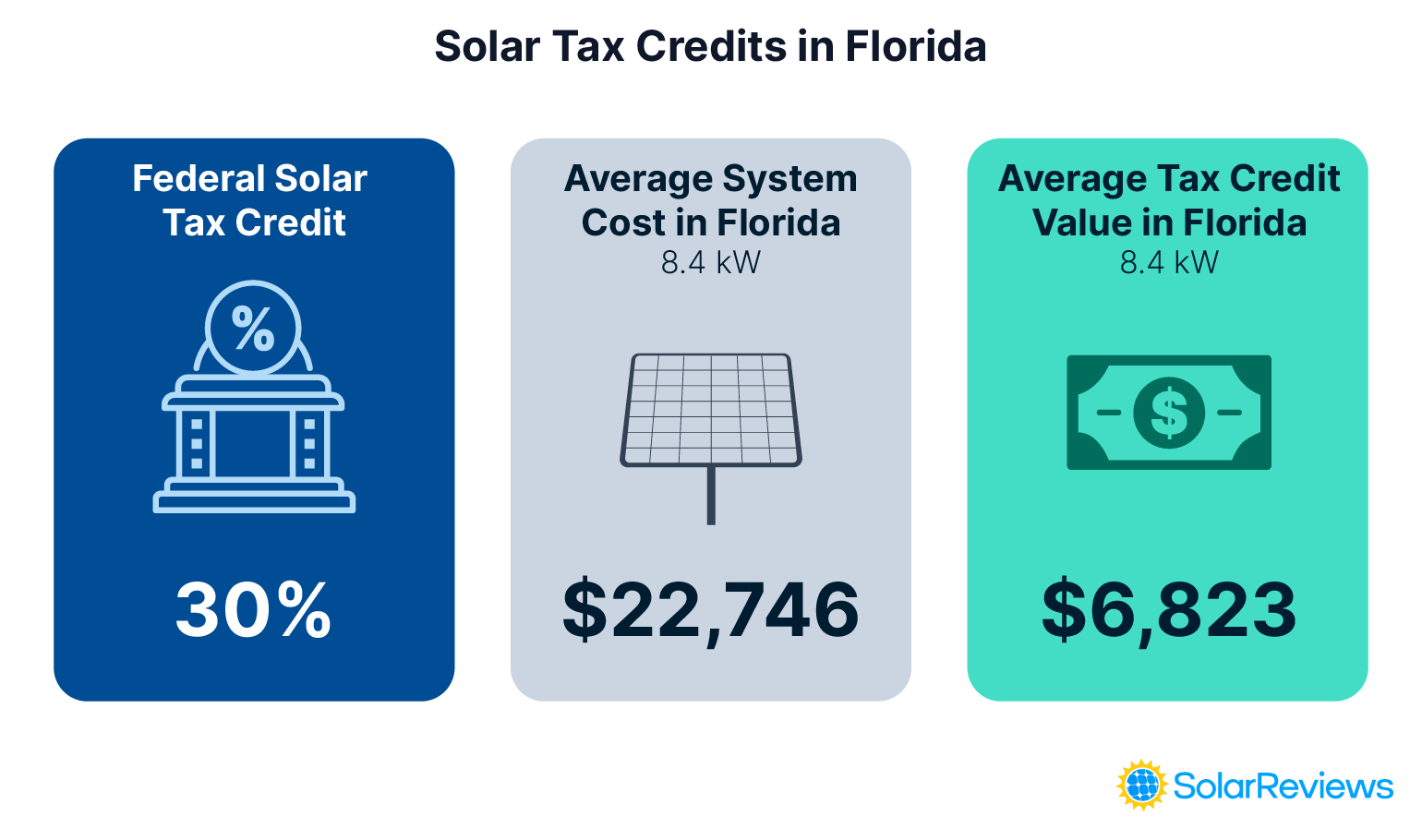

Florida homeowners can save $6,823 on average with incentives when they install solar panels, but savings could be even higher with local rebates.

Find out how much solar incentives can save you in Florida

Why you can trust SolarReviews

SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry experts have a combined three decades of solar experience and maintain editorial independence for their reviews. No company can pay to alter the reviews or review scores shown on our site. Learn more about SolarReviews and how we make money.

On this page

Try our solar cost and savings calculator

Why you can trust SolarReviews

SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry experts have a combined three decades of solar experience and maintain editorial independence for their reviews. No company can pay to alter the reviews or review scores shown on our site. Learn more about SolarReviews and how we make money.

Last updated: July 2025

Written by Catherine Lane Catherine LaneCatherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dyna...Learn more

With Florida solar incentives, you can save an average of $6,823 when installing solar panels. Florida is the third cheapest state for solar, and the state has an excellent solar buyback program, making solar panels well worth it in the Sunshine State.

With major tax incentives like the federal solar tax credit and a property tax exemption, you can keep more money in your pocket when you go solar in Florida. But exact savings vary depending on where you live, the system you install, and the solar company you choose.

Our solar experts created an up-to-date resource on Florida’s home solar incentives to help you learn how to qualify, save, and apply for all of the great rebates and tax breaks available to you.

Florida solar incentives guide

Incentive | Estimated average annual savings | Eligibility | About |

|---|---|---|---|

Federal solar tax credit | $7,560 | All tax-paying U.S. citizens | Tax credit equal to 30% of installation costs, applied to federal income taxes |

Solar property tax exemption | $250 per year, varies by location, system, and property value | Florida residents installing solar and other renewable energy equipment to their homes | 100% exemption of value of renewable energy system from property taxes |

Solar equipment sales tax exemption | Varies by system | All equipment associated with generating solar energy | Exemption from state sales and use tax |

Calculate how much you can save with Florida incentives

Florida solar tax credit

While Florida doesn’t have a statewide solar tax credit, residents can take advantage of the federal solar tax credit to help lower their solar costs. The federal tax credit, sometimes called the investment tax credit (ITC) or residential renewable energy credit, equals 30% of solar installation costs and directly reduces your income tax liability.

On average, a solar panel system in Florida will earn a tax credit of $6,823.Exactly how much you save with the federal tax credit depends on how much your solar power system costs, how many solar panels you install, and the solar company you choose.

The key thing to remember about the federal tax credit is that it lowers what you owe Uncle Sam, not the upfront cost of your solar energy system. You’ll see the savings when you file your taxes for the year using IRS Form 5695.

If you finance your solar panels through a solar lease, you won’t get the benefits of the tax credit. If you use a loan, be aware that most solar loan providers require you to make a lump sum payment of the value of the tax credit after 18 months.

Local solar incentives in Florida

Some towns and cities may offer localized solar incentives and special financing options to help their citizens reduce the cost of going solar. Here are some notable local solar incentives in Florida, but there may be more available in your area:

Florida solar incentive | Location | About the incentive |

|---|---|---|

Boynton Beach, FL | $1,500 rebate for solar installations on primary residence | |

Dunedin, FL | Grant rebate program offering $0.25 per watt of solar installed (up to $2,500) | |

Tallahassee, FL | Low-interest solar loan, $0 down payment, 10-year term, 5% interest up to $20,000 financed |

Some cities and utilities offer rebates for solar water heater installations, like Beaches Energy Services and Fort Pierce.

Use this solar incentives calculator to find the Florida solar rebates and incentives available near you

Florida solar tax exemptions

Florida provides certain tax exemptions for solar installations to help keep prices low and avoid increasing long-term costs for homeowners. Here are some details about Florida’s solar property tax and sales tax exemptions:

Florida’s Property Tax Abatement for Renewable Energy Property: 100% of the value of a solar panel system is exempt from property assessments, meaning going solar won’t increase your property tax bill. Consult your local property tax assessor for more information about the solar property tax exemption.

Florida’s Solar Energy Systems Sales and Use Tax Exemption: Solar equipment is not subject to Florida’s 6% sales and use tax. Your solar installer will handle the application for this incentive.

Florida solar incentives calculator: Find out your savings

Calculating how much solar panels will cost for your home after using Florida’s solar incentives can be done in three simple steps. We outline the steps for estimating how much a solar system will cost you below, but remember this is just an estimate! To get a more accurate idea of how much solar panels will cost in Florida, you can use our solar calculator or get quotes from local solar companies.

Step 1: Estimate how much solar panels cost in Florida

The total cost of a solar installation will depend on how many solar panels you install and the cost that the installer charges you.

Most homes in Florida need a solar system that is about 8.4 kilowatts (kW) in size to offset all of their electric costs. SolarReviews data shows that solar panels in Florida cost about $2.71 per watt of solar installed.

To calculate the total cost, simply multiply the system size in kilowatts by 1,000 to convert it to watts. Then, multiply the system size in watts by the cost per watt. Here’s an example for a typical solar installation in Florida:

8.4 kilowatts (kW) x 1,000 = 8,400 watts

8,400 watts x $2.71 per watt = $22,746 total cost

Step 2: Subtract the value of any rebates

The next step is to calculate any solar rebates you might earn through your utility or local government. Always subtract the value of rebates before you calculate the value of the solar tax credit.

For our example, let’s say we are eligible for the $1,500 rebate in Boynton Beach:

$22,746 total cost - $1,500 rebate = $21,246 cost after local rebates

Step 3: Calculate the federal solar tax credit

Finally, to find the effective system cost, you can find the value of the 30% federal solar tax credit. Just multiply the cost of your solar installation after any rebates by 30%, and that’s the value of your federal solar tax incentive

Using the same 8.4 kilowatt system in Boynton Beach, here’s how you would find the tax credit value:

$21,246 cost after local rebates x 30% federal tax credit = $6,373.80

$21,246 cost after local rebates - $6,373.80 federal tax credit value = $14,872.20 effective solar system cost

Use this solar incentive and rebate calculator to find out how much solar panels cost for your home in Florida

Net metering in Florida

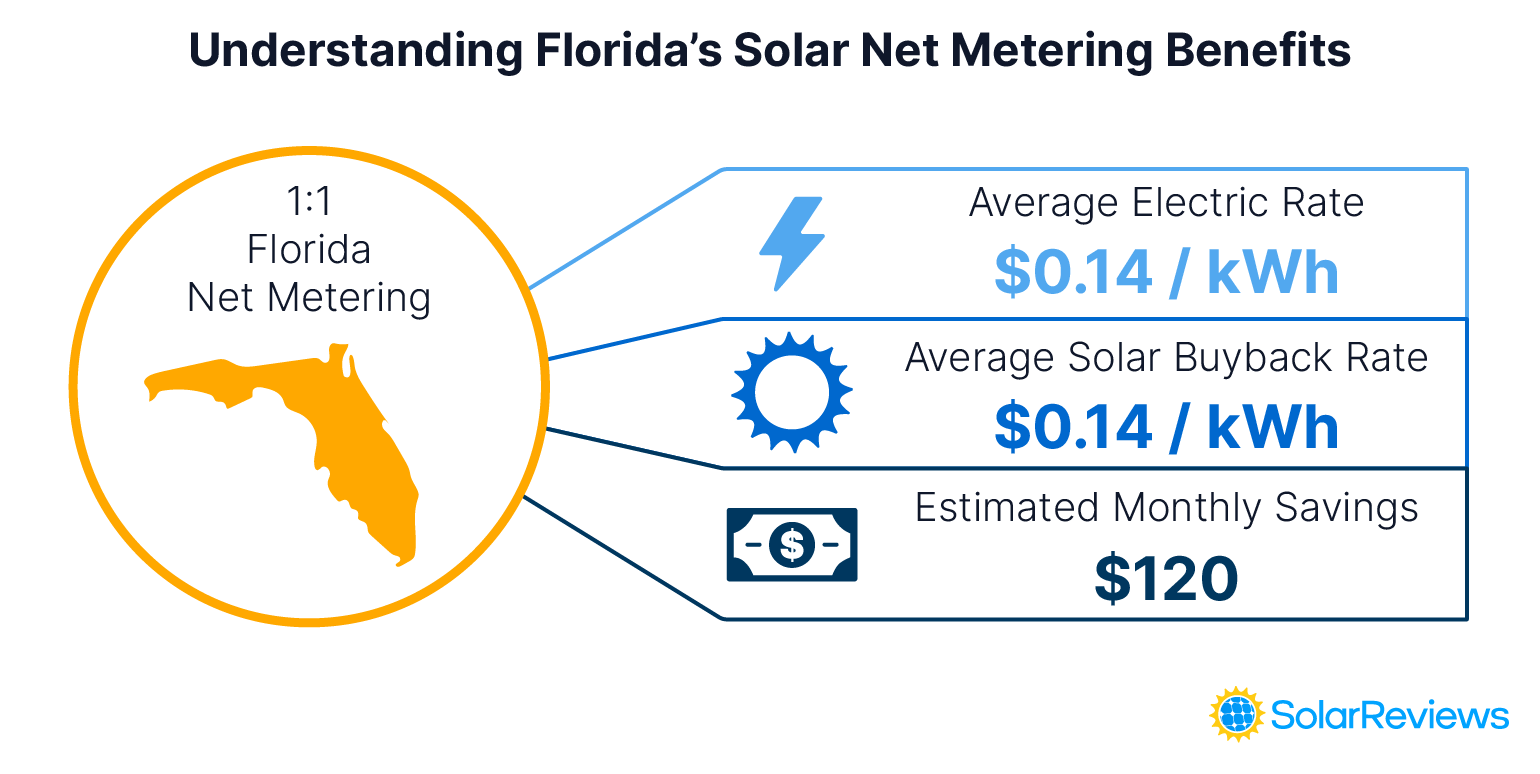

Net metering is a method utilities use to bill customers who install solar panels. Under net metering, solar energy generated on your roof is used by your house first. When your solar panels produce more electricity than your home needs, it gets sent to the utility grid in exchange for a bill credit that can offset the cost of electricity you use from the electric company later.

The value of these bill credits can vary depending on your utility, but Florida requires the major investor-owned utilities (Florida Power & Light, Duke Energy, Florida Public Utilities, and Tampa Electric Company) to pay you the full retail rate of electricity when you send excess energy to the grid. Basically, the rate you pay for electricity is how much you will get credited.

This is called full retail net metering, and it’s the best solar buyback plan for homeowners. Because of the state's net metering policy, Floridians can save a substantial amount of money on their electricity bills, potentially covering all of their electricity costs.

If you are served by an electric cooperative or local electric utility company, full retail net metering may not be available.

Guides for going solar with your Florida utility

Florida solar panel financing and loan options

In addition to solar incentives, there are two unique financing options available in Florida:

Property Assessed Clean Energy Program financing: PACE financing is a way to pay for solar panels where the loan is attached to your property, not you as the borrower, and is paid back through increases in your property taxes.

Solar and Energy Loan Fund: SELF is a nonprofit that provides low-interest loans that do not require a credit check for various home improvement projects, such as air conditioning, weatherization, energy efficiency upgrades, and solar panel installations.

These financing options aim to increase accessibility to solar energy by offering loans that are easier to obtain than traditional solar loans. However, just because you’re approved for PACE financing or a SELF loan, it doesn’t mean you can afford it. Be sure to fully understand how these financing options work, your personal finances and budgets, and sort out if this is really something you can afford to do.

Are there free solar panel programs in Florida?

No, you cannot get free solar panels in Florida from the government or a solar company. Companies that advertise free solar panels could be a red flag, and you should figure out what exactly they mean by “free.”

Often, claims of free solar programs refer to financing options like solar leases or $0 down solar loans. While these payment options require $0 upfront for solar, you still have to pay for the solar system or the solar energy it generates through monthly payments.

Solar battery incentives in Florida

Florida does not have any battery rebates or incentive programs for homeowners interested in energy storage. However, battery installations qualify for the federal solar tax credit, meaning you can get a tax credit equal to 30% of energy storage system installation costs.

Because Florida has full retail net metering and there are no energy storage rebates currently offered, battery storage in Florida is only worth it if you value having access to backup power when the grid is down. However, if you’re looking at it from a financial perspective, solar batteries won’t save you any additional money on your electric bills in the Sunshine State.

Find top solar companies in Florida

Aside from the fantastic solar incentives available to Floridians, you can also save money on a solar installation by comparing solar quotes. Not only will getting multiple quotes potentially save you 20% on the price of going solar, but it also gives you the chance to find the Florida solar company that’s just right for your needs.

We recommend getting at least three solar quotes from reputable solar companies that have been in business for at least five years and have consistent positive customer reviews. Once you’ve had a chance to see what each company has to offer, you can make an informed decision about going solar and start cutting down on your electricity bills!

Join the over 1.5 million Americans who have used SolarReviews to find reliable solar installers in their area

Other Florida solar panel resources

Catherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dynamic team in producing informative and engaging content on residential solar to help homeowners make informed decisions about investing in solar panels.

Catherine’s expertise has garnered att...

Learn more about Catherine Lane