Updated 3 months ago

Solar panel payback period and ROI: How long does it take for solar panels to pay for themselves?

Written by Ben Zientara Ben ZientaraBen Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state util...Learn more

Why you can trust SolarReviews

SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry experts have a combined three decades of solar experience and maintain editorial independence for their reviews. No company can pay to alter the reviews or review scores shown on our site. Learn more about SolarReviews and how we make money.

Adding solar panels to your home is the rare home improvement project that pays for itself. Once installed, solar panels make electricity that saves you from having to buy it from the utility company.

Depending on your utility cost, the time it takes to pay back the initial investment can be very short. In the United States, the average payback time for a home solar installation is about 10 years.

But the payback time and ROI is different for everyone. The time it takes an individual solar installation to pay back its cost depends on the size of the initial investment, the electric rate from your utility company, and how much sun the panels get.

Below, we’ll get into each of the things that goes into calculating the solar payback time, and then we’ll broaden the discussion to include the savings after payback. Solar panels on your roof should last for 25 years, and by looking at the total return on investment, they can be compared to other ways to invest your money.

If you’d rather skip the long explanations and math equations, you can calculate the payback period for your specific home now by using our solar panel payback calculator:

Key takeaways

Solar panels pay for themselves over time by saving you money on electricity bills, and in some cases, earning you money through ongoing incentive payments.

Solar panel payback time can range between 5 and 15 years in the United States, depending on where you live.

How quickly your solar panels pay back their cost depends on how much you paid, the price of electricity from your utility, and available upfront and ongoing incentives.

How is the payback period defined for solar panels?

"Solar panel payback period" is the amount of time it’ll take you to completely pay off your solar power system through savings on your electric bill.

It is calculated by taking the total cost to install the system, then subtracting solar incentives and/or rebates, and monthly electric bill savings until the total cost has been paid off.

For example, if you spend $16,000 on a solar panel system, then get a federal tax credit of $4,800, the cost after incentives is $11,200. Then if the solar energy your panels make reduces your electric bill by $1,500 per year, your payback period would be about 7.5 years, assuming electricity rates don’t increase.

You can learn more about solar payback period in this video with solar expert Ben Zientara:

Average solar panel payback period for homes in the U.S. in 2025

Most homeowners in the United States can expect their solar panels to pay for themselves in between 9 and 12 years, depending on the state they live in.

Some states, like Hawaii and Massachusetts, offer solar payback periods as short as five years, while payback time in states like Louisiana and North Dakota can stretch to 16 years or more.

The reason some states’ payback periods are worse than others isn’t just because they’re less sunny. It mostly has to do with the cost of electricity replaced by solar energy and the incentives available to help homeowners go solar. Other factors include roof composition and age, quality of equipment used, and whether you pay with cash or choose a solar loan.

To get an accurate estimate of solar panel cost, incentives, and payback for your home, use our state-of-the-art solar panel estimator. It shows you how panels will look on your actual roof, and by using solar production data from the National Renewable Energy Laboratory, will give you utility prices from the U.S. Energy Information Administration, as well as live cost information from installers all across the country.

What is considered a good solar payback period?

Photovoltaic solar panels are designed to last at least 25 years, and many modern brands will last much longer than that. When considering that lifetime, any payback period less than about half that time, or 12.5 years, can be considered “decent.”

More important than payback time is a concept called “Internal Rate of Return,” or IRR for short. IRR is expressed as a percentage of return on investment, and answers the question, “Considering the estimated future benefits of this investment, what percentage return would you need to get from another investment to be equal to this one?”

In the solar industry, we use IRR to compare the return on an investment in solar with the returns of other popular ways to invest.

For example, long-term investment in a broad stock index fund has historically resulted in an IRR of about 8% per year. A home solar system in a state like Virginia, where the payback time of an investment in solar is around 12 years, has an IRR of about 8%.

The good news is, there are many states with better IRR and payback time than Virginia, especially in the northeast and California, where electricity costs are very high. For example, people in Massachusetts, New Jersey, California, and New York can expect IRRs of between 16 and 20 percent—double or more of the average return of a long-term index fund.

What factors need to be considered to calculate an accurate solar payback period?

There are 5 primary factors influencing your solar payback period:

Average electricity usage for your home, which determines how many solar panels you need

Total system cost

Solar incentives, rebates, and the federal tax credit

Energy production from your solar system

Cost of electricity and rate of increase in that cost

Below, we covered each of these factors to show an example solar payback estimate for a house in Colorado served by Xcel Energy.

Step 1. Average electricity usage for your home

The first step toward determining solar payback is figuring out how big your solar panel system should be. To do that, you need to look at your average electricity usage, then design a solar system that makes enough energy to offset that usage over the course of the year.

Example 1

Let’s say our example home uses about 9,500 kilowatt-hours (kWh) of electricity per year. According to PVWatts, one kilowatt (kW) of solar panels in Arvada, CO can generate around 1,575 kWh per year. Divide 9,500 by 1,575, and you get a system size of about 6 kW.

Learn more: Guide to watts, kilowatts, and kilowatt-hours

Step 2. Total system cost before incentives

The next step is determining how much your system will cost. This number represents the final price of a solar installation before considering incentives. It is the number we’ll use to begin subtracting savings from to determine the payback period.

Example 2

As of January 2025, the national average cost of a 7.2 kW home solar system is about $3.03 per watt, or $17,700, before incentives. The homeowner in our example will either need to pay cash or take out a solar loan for around that amount.

Step 3. Solar incentives, rebates, and the federal tax credit

The great thing about installing solar panels is that it earns you a big tax break at the end of the first year. You can claim the federal solar tax credit equal to 30% of the total installation costs.

Many states offer additional solar incentives like rebates and performance-based incentives, as well.

Subtracting the dollar amount of available incentives from the total system cost gives you your net cost of solar panels.

Example 3

Our friend in Arvada is in a great place for solar. Despite what you may think of Colorado as a snowy place, it actually gets as much sun as parts of east Texas, Louisiana, Mississippi, and Alabama.

The 6-kW system in question would earn its owner a tax credit of $5,310 based on our estimated upfront cost of $17,700. That means the net cost of the system is just $12,390. That’s the number we’ll use to start subtracting energy bill savings from.

Step 4. Energy production from your solar system

This step is pretty simple but very important.

Once you know your system size, multiply the number of kW your solar panels can produce under full sun by the number of kWh that 1 kW can produce over the course of a year. In the next step, multiply that number by the amount you pay for every kWh from your utility.

Example 4

We mentioned above that each kW of solar panels in Arvada can produce about 1,575 kWh of electricity per year, on average. So take that number and multiply it by the 6 kW of our system size, and our friend can expect their panels to make about 9,450 kWh per year.

Step 5. Cost of electricity and rate of increase in that cost

Here’s where the rubber meets the road. In a state with net metering, you can take the number of kWh your system will produce in a year and multiply it by your per-kWh rate from the utility. That number will equal your annual solar savings.

To get a simple solar payback time frame, just divide the net cost from Step 3 by your average annual savings to get the number of years it will take for your solar savings to equal the net cost of the system.

Unfortunately, however, it’s not always that easy. Why? Because electricity rates increase over time, and some states do not offer net metering.

Example 5

Here’s where our friend in Arvada finally learns their solar payback period!

Colorado's net metering law is nice and simple, with the utility required to provide a 1-to-1 credit for every kWh of solar electricity sent to the grid. Each kWh from Xcel costs around $0.143, meaning that 9,450 kWh of solar production will save them around $1,350.

Dividing $12,390 by $1,350 gives a solar payback period of about 9.2 years, even with no electric rate increases between now and then.

If their solar panels were fully connected by July of 2025, they’d be paid off before the holidays of 2035 and will keep making electricity until at least 2050. That’s what we’d call a great deal!

Electricity rates increase over time

The rate of increase in electricity rates is the most difficult thing to predict when it comes to solar payback. Over the past 25 years, rates in the United States have increased by an average of about 2.5% per year, but that rate varies widely based on location.

States like California have seen their rates increase by as much as 10% per year, while others like Minnesota have been increasing at closer to 1-2%. The best predictor of future changes in the history of your own utility company’s rate increase requests. This is one area where it pays to do your research before buying.

Some states don’t offer net metering

In a state without net metering, excess solar energy is usually credited to your bill at what’s called the “avoided cost rate.” That’s basically the utility’s wholesale energy price; usually just a couple of pennies per kWh. Some of the solar electricity your panels make will still save you the retail rate because you’ll be using it to power your home’s appliances and devices.

If this sounds confusing, don’t worry. It is confusing! Luckily, our solar calculators are built to handle the difference between net metering and alternative compensation. Begin by entering your ZIP code and electricity bill, and we can determine your usage, system size, payback time, and more.

How to calculate ROI for solar panels

Things to know about solar panel ROI:

The average ROI on solar panels in the United States is about 10%

Solar panel ROI varies widely based on location and the specifics of your home

If you have a solar estimate with cost and savings projections, you can use modern spreadsheet programs to make ROI easy to calculate

The ROI of solar panels can be calculated by taking net installation cost after one-time incentives versus expected electric bill savings and ongoing incentives over time.

Let’s be clear here that solar ROI is not the same thing as payback time. Knowing how long it will take for solar panels to pay back their cost is only half the information necessary. The other half has to do with the rate of return you can expect, based on average expected savings over the lifetime of your solar system.

This is where the internal rate of return, or IRR, comes in. According to Investopedia, IRR is “a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis”.

That’s a complicated way of saying “it’s the rate you’d need to earn on an investment to match the return you’d expect to get from what you’re considering now (in this case, a home solar energy system).”

The formula to calculate it looks like this:

Image source: Investopedia

Fortunately, you don’t need to use that complicated formula to figure out solar panel IRR, because the SolarReviews solar panel calculator can do the work for you. Here’s a video that explains how to use our calculator to determine the IRR of your solar system based on the numbers in an installer’s quote:

However, if you’re the kind of person who likes to do the math yourself, you can figure out IRR by putting all the variables into a modern spreadsheet program.

The IRR function in spreadsheet programs

Thanks to programs like Excel and Google Sheets, calculating IRR is actually pretty simple.

First, lay out a column with 25 cells that represent each year (most solar panels are warrantied for 25 years).

In the first cell, start out with system cost after upfront incentives, which represents the amount you invested. Subtract from that all first-year tax incentives and savings on electricity costs (kWh produced multiplied by your retail rate in net metering states). The result should be a negative number that represents the net first-year investment in your solar panel installation.

For each of the next 24 years, the cells should contain positive numbers equal to the value of ongoing energy bill savings and incentives. Expect solar energy production to go down by about 0.5% per year, and the cost of electricity from the utility company to increase by around 2.5% per year (electricity cost increases could be more or less depending on where you live).

If your PV system will be using a central solar inverter, expect to replace it somewhere between Year 10 and 15, and reduce that year’s profits by about $1,500.

On the other hand, if you’ll be using microinverters, they should last 25 years (and come with warranties for that period), so you don’t have to add that additional expense.

For example, let’s say the values you’re looking at here are in cells C2 through C26 in your spreadsheet. In cell C27, type “=IRR(C2:C26)”. The program will do the rest, and will output a percentage.

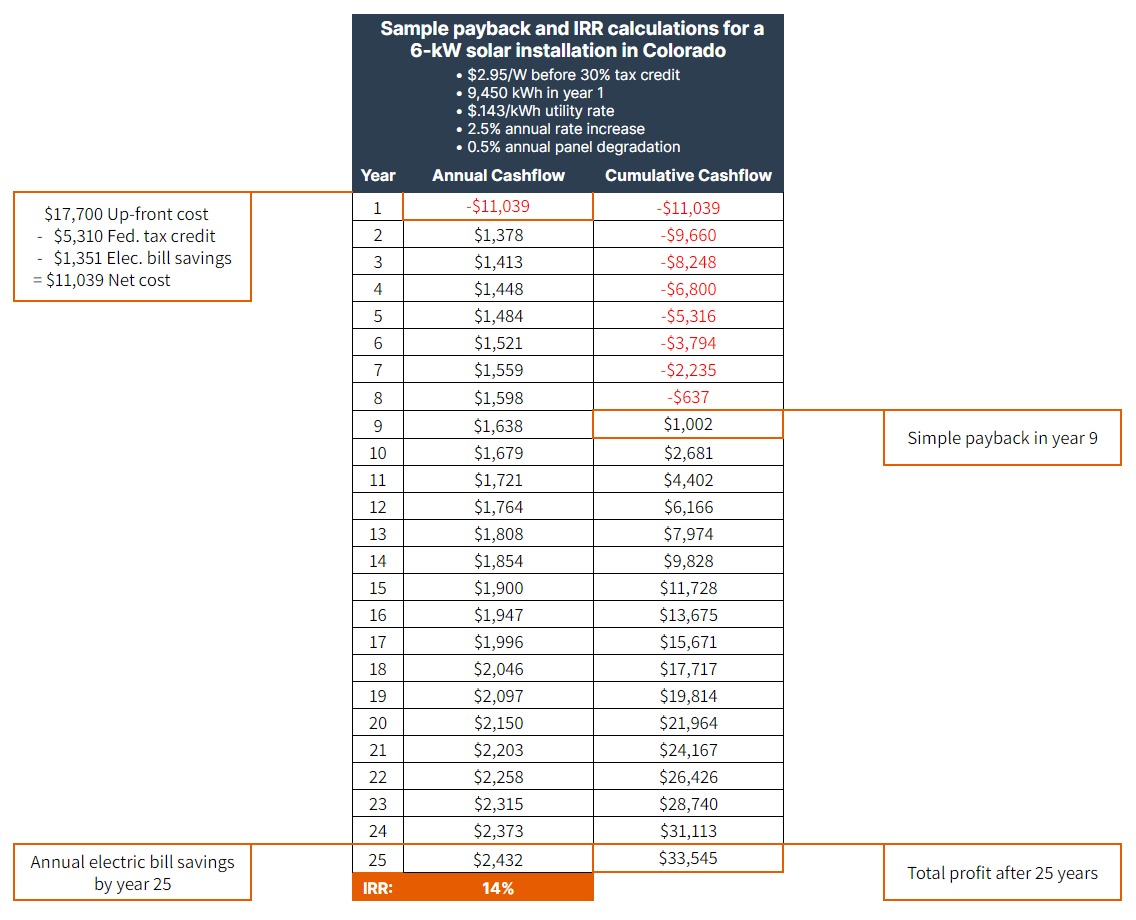

Here are the calculations for a home solar panel system in Colorado:

This is how to represent the annual and cumulative savings of solar.

The image above shows how a 6-kW solar system starts at an estimated total cost of $17,700, which is then reduced by $5,310 because of the federal tax credit and $1,351 in electricity bill savings over the first year.

The savings add up over 25 years, resulting in $33,545 total profit and an IRR of 14%.

Comparing the ROI of solar energy to other investments

So is that 18.64% IRR any good? In order to determine what IRR means you have to compare it to your next-best investing option.

Putting money in your sock drawer returns 0%, because you don’t earn any interest on money that’s socked away (ba dum tss). Open an online savings account and you might get 3.5% back per year. But the benchmark financial experts usually use to compare investments is the historical return of the stock market.

The S&P 500 has returned about 8% per year over the past 90+ years. That means, instead of purchasing solar panels for your home, you could buy shares in the SPY index fund that tracks the performance of the S&P 500, and probably earn about 8% over the next 25 years.

Considering that our sample calculations for Colorado showed an estimated 14% annual return, we estimate that an investment in a solar installation there is nearly twice as good as a similar investment in a broad index fund like SPY.

Why does SolarReviews claim to have the only truly accurate solar panel payback calculator?

Our site can claim to have the only truly accurate solar panel payback calculator because we use customized local and home-specific information, whereas other sites simply use generic assumptions for some or all of these things.

Specifically, our calculator:

Uses the exact solar production from your local weather station

Adjusts solar production estimates to the direction and tilt angle of your roof

Applies the exact electric rate structure charged by your utility to calculate accurate savings, instead of just a generic rate for power

Checks current local solar offers from solar providers near you to calculate a realistic cost to use in your payback calculation

Final word on solar panel payback period and ROI

Now that you’ve read through the steps outlined in this article, you can calculate the estimated solar payback period and ROI if you’ve received a quote for home solar panels. If you haven’t yet received solar panel quotes, you can start the process by using our solar panel calculator and learning about offers from solar providers in your area.

Remember, the method above just results in a simple payback estimate, without accounting for increases in electricity costs over time, solar panel degradation, or any other factors.

In addition to electric bill savings, there are other benefits of solar panels which aren’t as easy to put a value on. The most important of these is an increase in home value, estimated to be about 6.9% of the pre-solar value of your home.

On top of that, there are environmental benefits of renewable energy and, if you add batteries to your solar installation, the peace of mind that comes with being more resilient if the power goes out.

Adding solar panels to your home truly does add value in many ways.

Ben Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state utility policy since 2013. His early work included leading the team that produced the annual State Solar Power Rankings Report for the Solar Power Rocks website from 2015 to 2020. The rankings were utilized and referenced by a diverse mix of policymakers, advocacy groups, and media including The Center...

Learn more about Ben Zientara