Updated 5 months ago

The Federal Solar Tax Credit: How it Works in 2025

Written by Catherine Lane Catherine LaneCatherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dyna...Learn more , Edited by Ben Zientara Ben ZientaraBen Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state util...Learn more

Use this federal solar tax credit calculator to find out how much you can save on solar

Why you can trust SolarReviews

SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry experts have a combined three decades of solar experience and maintain editorial independence for their reviews. No company can pay to alter the reviews or review scores shown on our site. Learn more about SolarReviews and how we make money.

The federal solar tax credit is the most widespread solar incentive in the United States. Every U.S. taxpayer who purchases a solar installation is eligible to receive 30% of the cost back as an income tax credit in the year after installation.

If you’re thinking about getting solar panels installed, it’s important to know how the tax credit works, how much it may be worth to you, and how it combines with other solar incentives. Let’s dig in.

Key takeaways

The federal solar tax credit is a dollar-for-dollar income tax credit equal to 30% of solar installation costs.

The average federal solar tax credit is $6,544, based on an estimated cost of $21,816 for a 7.2-kilowatt solar installation.

To qualify for the federal solar tax credit, you must purchase the solar panels with cash or a loan, have taxable income, and it must be installed at your primary or secondary residence.

Eligible equipment for the federal tax credit includes photovoltaic solar installations, battery storage, solar water heaters, geothermal pumps, fuel cells, and wind turbines.

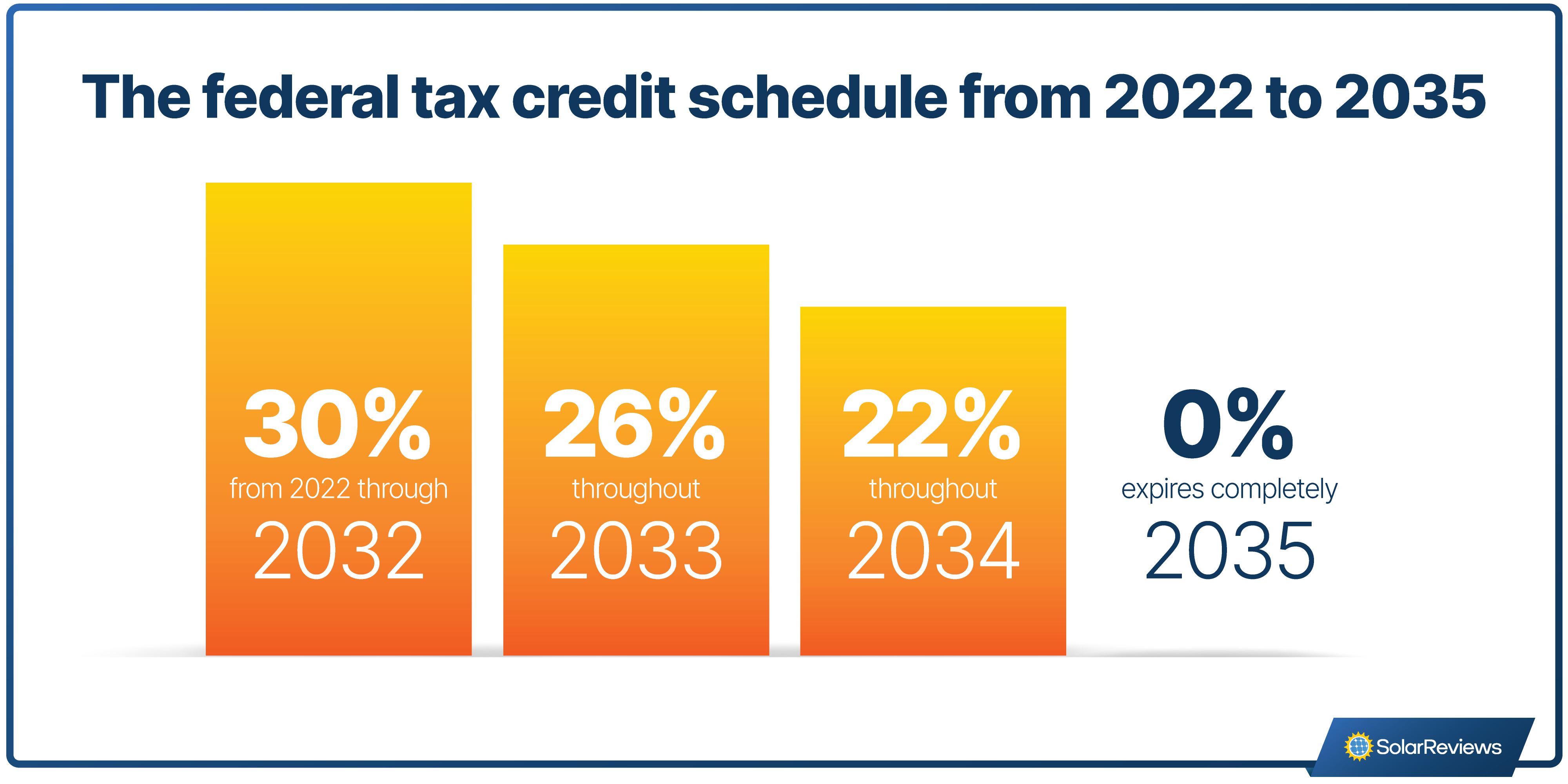

The 30% solar tax credit is available until 2032, before reducing to 26% in 2033, 22% in 2034, and expiring completely in 2035.

Disclaimer: SolarReviews does not provide tax or accounting advice. This has been prepared for informational purposes only. Please consult a tax professional.

What is the solar tax credit?

The federal solar tax credit, formally known as the Residential Clean Energy Credit, is an incentive you can earn when installing solar panels or other clean energy equipment on your property. The tax credit equals 30% of installation costs and can reduce what you owe in federal income taxes by thousands of dollars.

It’s one of the best tax credits that is widely available to all taxpayers. The reduced energy bills, coupled with the tax credit, should help homeowners with the initial cost of purchase and installation.

Learn more about what the federal tax credit is and its benefits from our solar expert, Ben Zientara:

How does the federal solar tax credit work in 2025?

In 2025, the federal solar tax credit equals 30% of solar installation costs, directly reducing your federal income tax liability.

Here’s an example of how the solar tax credit works: If you installed a home solar power system for $20,000, you could claim a tax credit of $6,000.

$20,000 solar installation costs X 30% = $6,000 tax credit value

So, if your tax liability was $15,000, the $6,000 tax credit would reduce what you owe to just $9,000.

$15,000 income tax liability - $6,000 solar tax credit = $9,000 final bill

The tax credit is nonrefundable, meaning it can’t reduce your full tax bill to less than $0, and the federal government won’t give you a refund if your credit amount exceeds your liability. However, any remaining credit value can roll over to the subsequent tax year if the value of your tax credit is greater than what you owe.

Let’s use another example: Ifyou installed the same system above and got a $6,000 tax credit, but you only owed $5,000 in taxes, your tax liability would be reduced to $0. The remaining $1,000 from your credit can be applied to your taxes next year.

$5,000 tax liability - $6,000 tax credit = $1,000 credit roll-over to apply to next year’s taxes

Expert advice! We’re going to be honest with you: A lot of what you see online makes it sound like the solar tax credit will directly lower the cost of your solar energy system. Don't be fooled! You will still pay the full price for your solar panel system when it is installed. You’ll see the benefits on your taxes when you file for the year.

Will the 2025 solar tax credit increase my tax refund?

Depending on what you owe and how much you withheld for the year, you may see a higher tax refund when you claim the federal solar tax credit, depending on what you owe and how much you withheld for the year.

If you have already withheld enough money from your paychecks to cover what you owe, you will earn whatever refund you would usually get when filing your taxes, plus the tax credit value.

Kleczynski provided SolarReviews with an example to illustrate how the solar tax credit could impact a federal tax return:

“Let’s say you earned a tax credit of $6,000. If you owed $20,000 in taxes but withheld $25,000 throughout the year on your paychecks, your refund would be $11,000: $6,000 from the federal tax credit and $5,000 from the income taxes.”

However, you won’t always get the tax credit back in your refund check. If you didn’t withhold enough money throughout the year to cover your liability, the credit will simply lower your liability.

How much is the federal solar tax credit worth in 2025?

Our calculations for the average cost of solar panels show you should expect to pay $21,816 for a typical 7.2-kilowatt system. That means the average solar tax credit is $6,544 (30% of $21,816).

However, your solar tax credit will vary based on how much you spend on solar and your tax liability. Liability simply means how much you owe in total income taxes for the year.

When does the federal tax credit expire?

Remember that the federal solar tax credit won’t be around forever! The solar tax credit is on a step-down schedule, meaning its value decreases until it expires completely in 2035. So, a $20,000 solar system installed in 2025 will earn a credit of $6,000, while that same system will only earn a $5,200 tax credit in 2033.

The solar tax credit was first enacted as part of the Energy Policy Act of 2005 to encourage the adoption of solar projects throughout the U.S. It was extended as part of the Emergency Economic Stabilization Act of 2008 and the Consolidated Appropriations Act of 2016, which pushed its expiration date to 2022. Then, President Joe Biden extended the tax credit once again when the Inflation Reduction Act of 2022 passed.

Will Donald Trump take away the 2025 solar tax credit?

There is a lot of concern among people who are interested in getting solar panels that the Trump administration will take away the solar tax credit before people can claim it for 2025. That concern is understandable, but based on our research, there isn’t much to worry about—at least for this year.

The availability of tax credits is set by laws, and under the control of Congress. In order to make a change to the availability of tax credits, a new law would have to be passed. Lawmakers have not shown any interest in passing such a law, and the idea of taking tax credits away from people who expected them would be extremely unpopular.

The history of the solar tax credit shows us that the incentive has bipartisan support. We feel quite confident that the solar tax credit will survive 2025.

What is the investment tax credit (ITC)?

The solar investment tax credit, also called the ITC, is a special version of the federal solar tax credit that is meant for businesses. Like the Residential Clean Energy credit, the ITC is worth 30% of the costs a business pays to have energy properties like solar panels and battery storage technology installed. But the ITC goes further.

The rules for the ITC are laid out in Section 48 of the U.S. tax code. Additional rules in Section 48 provide bonus energy tax credits for projects that are built in low-income communities and/or use domestic content (i.e. US-manufactured materials) in the installation.

Under these rules, the ITC can be expanded to up to 50% of the cost to install a system.

2025 federal solar tax credit qualification checklist

The federal solar tax credit is available across the entire United States, but it’s most beneficial for homeowners with high electricity bills, high tax liabilities, and those who value clean energy.

Here is a checklist of some key eligibility requirements you must meet to earn the solar tax credit:

You must pay for the installation of qualifying equipment: Solar panels, solar shingles, solar water heaters, residential wind turbines, geothermal heat pumps, fuel cells, and battery storage systems are all eligible for the federal solar tax credit.

You must own the system: To use the tax credit, you must purchase the solar panels with cash or a loan. You will not get the tax credit if your solar panels are installed through a solar lease or a power purchase agreement (PPA) because you are not the owner of the system.

You must have taxable income. The tax credit reduces your tax liability. If your tax liability is zero, you can’t take advantage of the incentive immediately. However, you may be able to roll the credit forward if your tax bill increases in the following years.

The solar system must be installed at your primary or secondary residence: You must be the person residing on the property to get the Residential Clean Energy credit. Rental properties do not qualify for the federal tax credit.

It must be claimed on the original installation of the equipment: If you remove the panels and put them on another property or install used solar panels, you cannot reclaim the tax credit. It must be the first time the panels are used. You can, however, claim the tax credit for any costs incurred when adding solar panels to an existing system.

The tax credit can be used for solar panels installed on houseboats, mobile homes, and condominiums as long as they are primary or secondary residences.

The federal solar tax credit has no income limit! Anyone with taxable income can take advantage of it.

How to file for the federal solar tax credit incentive

Claiming the tax credit is easy! Simply fill out the associated forms when you file your annual taxes.

According to the Internal Revenue Service (IRS), the solar tax credit should be claimed on your return for the tax year the solar panel system receives Permission to Operate (PTO) from your utility company, not the date the system was purchased. For example, if your solar panels were purchased in December 2023, but your utility didn’t provide you PTO until 2024, you would wait to claim the tax credit on your 2024 tax return.

You can read our step-by-step guide to using Form 5695 for more details, but here are the basic steps to know about claiming the tax credit:

Fill out line 1 of IRS Form 5696, labeled “qualified solar electric property costs,” with the total cost of the solar system. If you install energy storage or other qualifying equipment, list the total costs on the corresponding lines.

Calculate the total credit value by multiplying the total qualified costs by 30%.

Add any other credits you’ve earned, such as the energy-efficient home improvement credit.

Fill out lines 14 and 15 of IRS form 5696 to see if you have any solar tax credit roll-over for next year’s return

Add the final tax credit value to IRS Form 1040 to calculate your final tax liability.

When using a tax software program, you’ll likely have to search for tax Form 5695 in the system, add it to your other tax documents, and input relevant information, like the cost of the system. The software will handle the calculations and determine your final tax liability. If using a tax professional, you can provide them with the cost of your system, and they’ll handle the rest.

What costs are eligible for the federal solar tax credit?

Most of the costs associated with installing solar panels are covered by the federal tax credit, including:

Equipment: The cost of solar equipment, including solar panels, wiring, racking, and inverters, is eligible for the tax credit. Home battery installation costs, even if the battery is installed without solar panels, also qualify for credit.

Contract labor: Labor costs associated with site preparation, planning, and installation qualify for the tax credit.

Permitting and inspection costs: Any permitting or inspection costs incurred when installing solar panels are covered by the tax credit.

Sales tax: The tax credit covers any sales tax associated with the above costs.

However, some costs are not eligible for the tax credit. For example, the credit will not cover roof replacements and extended warranty coverage costs. Most notably, financing costs are not included when calculating your tax credit value.

Expert insight! “You can still claim the full cost of the solar panels if you finance instead of purchasing outright. However, financing costs and interest would not be eligible to include only the cost of the solar panels and installation,” says Certified Personal Accountant and Tax Manager Joe Kleczynski.

Does the federal tax credit work with other local or utility solar incentives and rebates?

You can combine the federal solar tax credit with other incentives like state solar tax credits to maximize your solar savings. However, whether it’s a utility rebate, a state tax credit, or a performance-based incentive can impact how the federal solar tax credit is calculated. Let’s take a closer look.

Utility rebates

In most cases, if you’re getting a rebate from your utility company, the value of the utility rebate will be subtracted from your total costs before the federal tax credit is calculated. This reduces the value of your federal tax credit, but you benefit from the additional incentive.

For example, let’s say you install a solar system for $20,000 and get a $1,000 rebate from your utility company. Instead of calculating the tax credit with the initial $20,000 cost, it would be based on the price after subtracting the utility rebate. In this case, that’s $19,000.

You can use the following formula to calculate how much your tax credit will be worth after a utility incentive:

30% x (Total system cost - Utility rebate amount) = Federal tax credit value

State solar tax credits

Some states offer solar tax credits that work similarly to the federal tax credit. The state tax credit will be worth a certain percentage of the solar installation costs and reduce taxpayers' state income tax liability.

A state tax credit won’t impact the value of your federal tax credit. However, claiming a state solar tax credit will change the amount of taxable income you report on your federal taxes.

The following table outlines where state-specific solar tax credits are available:

State | Tax credit |

|---|---|

25% of costs, up to $1,000 | |

35% of costs, up to $5,000 | |

Deduction of 40% of costs in year 1 up to $5,000, 20% in years 2-4 | |

15% of costs, up to $1,000 | |

10% of costs, up to $6,000 | |

25% of costs, up to $5,000 | |

25% of costs, max of 50% of tax liability in any given year, roll over unused credit for up to 10 years |

Performance-based incentives

Performance-based incentives are paid to solar homeowners based on how much energy their solar system produces. These incentives likely will not change the value of your federal tax credit, but if they are considered additional income, they may impact your taxes overall.

Sometimes, these incentives may be listed as a line item on your electricity bill; other times, you’ll receive a separate payment from your utility company.

Some states have Solar Renewable Energy Certificates (SRECs), where a solar owner earns a certificate for every 1,000 kWh of solar energy they produce. These can then be sold to utilities or SREC aggregators and earn you extra money.

Sometimes, SRECs can be purchased upfront by the installer. If this is the case, you should consult a tax professional about how that could impact your solar tax credit value.

The best time to claim the solar tax credit is now

You have about ten years to take advantage of the full 30% tax credit. But just because you can wait ten years doesn’t mean you should. It’s almost always a good idea to invest in solar sooner rather than later. Installing solar as soon as possible lets you start saving money earlier, so you can stop paying high electricity bills and start putting your money towards the things that really matter to you.

Not to mention, going solar will never be a better investment than it is right now. Local solar incentives could expire well before the federal tax credit. Take net metering, the incentive that pays you the full price of electricity for the solar energy you send to the grid, for example. Utilities across the country are moving away from net metering and paying solar customers less money for solar electricity.

You’ll want to install solar before things like net metering and utility rebates start to disappear to guarantee that you get the best solar savings possible.

Federal solar tax credit FAQ

How much is the federal solar tax credit worth?

The 2025 federal tax credit for solar installations is equal to 30% of solar installation costs. The average tax credit value is about $6,000, but the actual tax credit you earn depends on how much your installation costs.

When do I claim the solar tax credit?

You claim the tax credit when you file your taxes for the year the solar system was installed. So, if you installed solar in 2022, you would claim the credit when you file your 2023 federal tax return.

You must claim the tax credit in the same year the panels received Permission to Operate (PTO). If you didn't claim it in time, you can file an amended return to get it.

Can I use the solar tax credit with a solar loan?

Yes, you can use the solar tax credit if you paid for solar with a loan!

Many solar loans require you to pay the full value of the tax credit on your loan before 18 months to keep your loan payments low. If you don’t, your loan payments will increase. So, make sure you have that money on hand to pay down your loan when 18 months rolls around.

What types of property qualify for the federal tax credit?

Solar panels installed on houseboats, mobile homes, and condominiums can claim the federal tax credit if the borrower and the system meet all other eligibility requirements. Secondary residences like vacation homes can also qualify.

Can I claim the tax credit on a DIY solar installation?

Yes, you can claim the solar tax credit on a solar photovoltaic installation you install yourself. However, DIY solar installations will not include labor costs, resulting in a lower tax credit value. You may not qualify for certain local incentives if you choose the DIY route.

Can I claim the tax credit for solar installations on a rental property?

No, you cannot claim the Residential Clean Energy Credit on rental properties unless you also live in the building. However, your rental property may be eligible for the commercial solar tax credit (IRC Section 48).

Can I claim the tax credit on a vacation home?

Yes, you can claim the tax credit for solar installations on secondary residences. But check with your tax provider to determine if your vacation home meets the requirements to qualify.

Does battery storage qualify for the federal tax credit in 2025?

Battery storage does qualify for the federal tax credit, so long as the battery has a capacity over 3 kilowatt-hours (kWh). Previously, batteries were only eligible if they were connected to a qualified solar system. However, after the IRA passed, standalone batteries can now also take advantage of the tax credit.

Can I claim the solar tax credit if I participate in a community solar program?

According to the Department of Energy, you may be eligible for the tax credit if you purchase an interest in a community solar project. The IRS has previously issued a private letter ruling allowing someone to do this, but that doesn’t act as a precedent for all taxpayers. You can’t claim the credit if the electricity generated by the interest exceeds your home energy usage or if you only purchase the electricity from a community solar program.

Everyone’s situation is unique! For specific questions on your tax situation, consult your tax preparer.

Catherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dynamic team in producing informative and engaging content on residential solar to help homeowners make informed decisions about investing in solar panels. Catherine’s expertise has garnered attention from leading industry publications, with her work being featured in Solar Today Magazine and Solar ...

Learn more about Catherine Lane