See how much it costs to install solar panels for your home

Based on your:

Location

Electric bill

Prices of the best-rated solar companies near you

Location

Electric bill

Prices of the best-rated solar companies near you

SolarReviews has both an extensive collection of unbiased consumer reviews of U.S. solar companies and an expert ranking system to help you identify the best solar panel installation companies in your area.

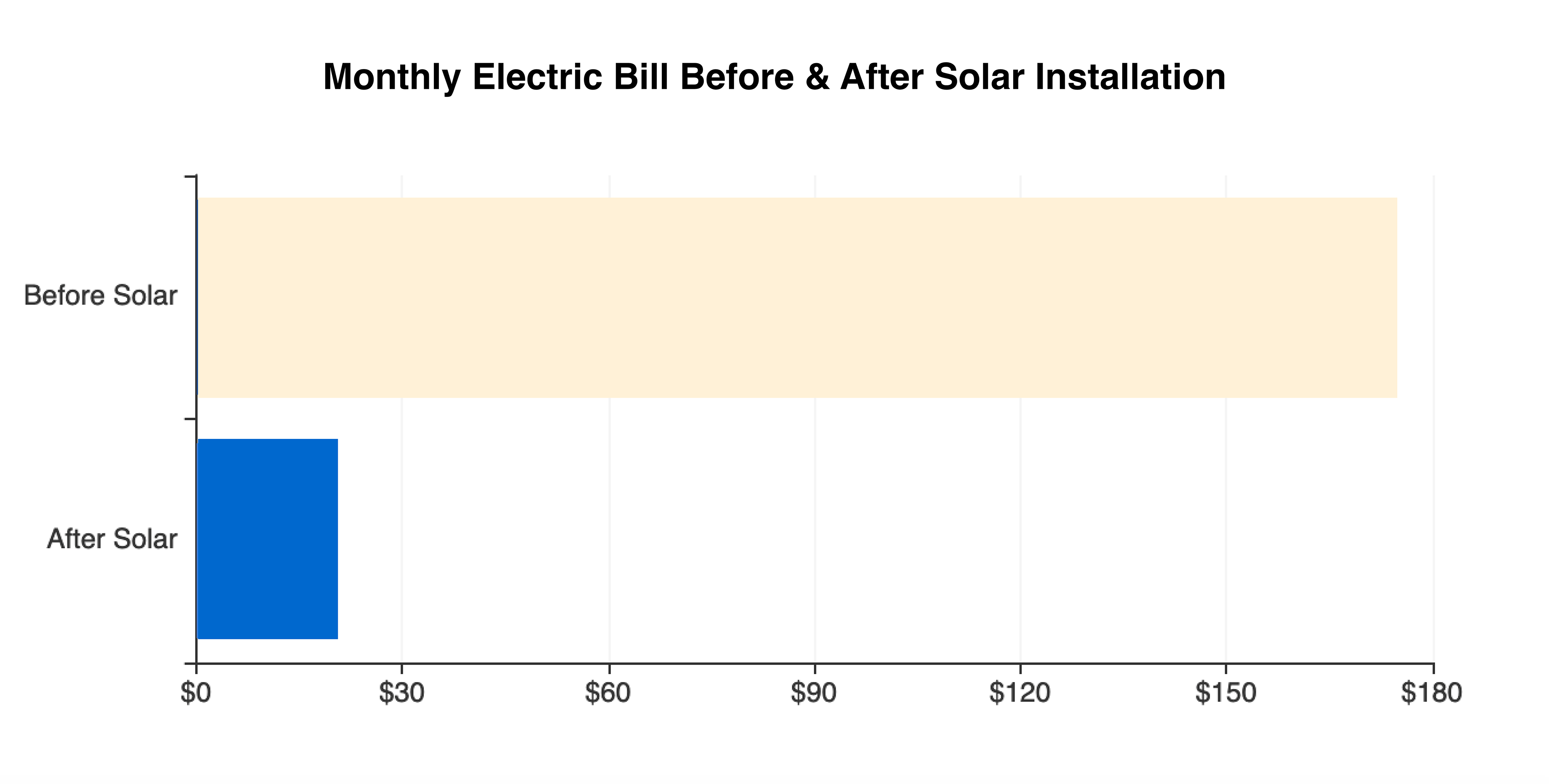

Since 2013, our in-house solar experts and engineers have built one of the most accurate solar calculators available. Homeowners can use our solar calculator tool without inputting any personal information, so they can evaluate the economics of installing solar panels on their homes.

Bill Hardy

"Calculator was easy to use and very accurate. I had solar installed a couple of years ago. I wanted to check what the calculator would give as a recommendation and forecast compared to my actual experience. My actual experience was well within the ranges given. GREAT TOOL."

Michael Le

“Very responsive and helpful. Got a friendly phone call right away after filling out online estimate to gather additional information. Knowledgeable and friendly. Can’t ask for more.”

Adrian Uribe

"Very helpful with information about cost, effectiveness and options for various solar panel installations. Very quick to reach out to me and explain things clearly so I understood exactly what my obligations would be and what I should expect from the system.”

Both Andrew Sendy, President of SolarReviews, and Lachlan Fleet, CEO of SolarReviews, have founded solar companies that are among the largest in their respective markets today. This expertise continues through the SolarReviews editorial team, which has a combined total of more than 50 years of solar industry experience.